Mikee

Active Member

- Jul 8, 2017

- 162

- 102

With all of this hype surrounding cryptocurrency is begs to put into question as to what a world would look like if cryptocurrency really does replace fiat money. Although the growth of crypto is booming in its markets, it still seems like a far stretch to say that it’ll replace fiat anytime soon. Nevertheless, I believe that it’s important that we examine the potential effects of crypto on our economic world.

Most (if not all) cryptocurrencies work by having a set capital limit on the circulation of the coin. Whether that be Bitcoin, Etherum, Ripple, or Doge coin, there is a set limit. In relation, this is how all standard since governing bodies like the federal reserve work, as they also put (mostly try) a limit on how much fiat money should circulate. That’s all fine and dandy, but I think an important point we’re missing is that even though the fed puts a limit on the amount of fiat produced, the amount of capital that the economy has grows naturally everyday !

This process is known as Fractional Reserve Banking, and it is the backbone of well, just about any economy that we have today. How fractional banking works is actually quite simple. Lets say Bob walks into his local bank with $1000 in his pocket to deposit into his account. The bank now has a $1000 liability in their book (of Bob’s cash). Lets also assume that monetary policy has stated that all banks must have a 10% reserve requirement. Accordingly, the bank must have at all times 10% of Bob’s money at their disposal ($100). The other $900 can be used to do as they wish, which they usually loan with, for the obvious reason so they can earn interest on that Loan.

They then loan the $900 to Lisa. Now lets stop for a moment and reflect. The economy at this point has grown by $900. But how you ask, well Bob has $1000 and Lisa now has $900 ! So our simplified economy is worth $1900 !

Lets take this one step further, Lisa then depoists her $900 in her bank, which also has a 10% reserve requirement. The bank as a result must hold at all times $90, and can lend out $810, which it does to Joe. Reflection: At this point the economy is now worth $1000 + $900 + $810 = $2710

In summary, the multiplier affect states that the economy will be worth $1000 * (1/0.1)

$10’000 as a result of fractional reserve banking. Crazy huh, Bob’s simple $1000 grew the economy by $9000.

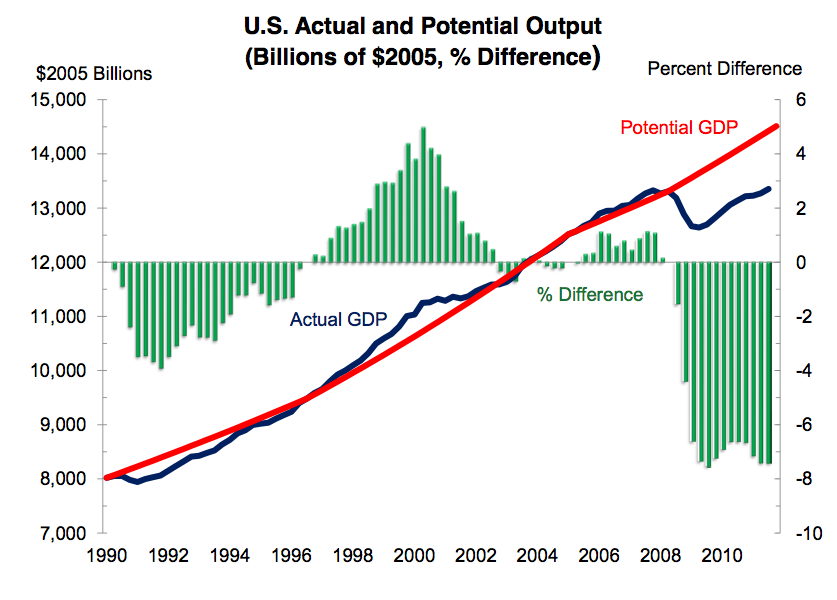

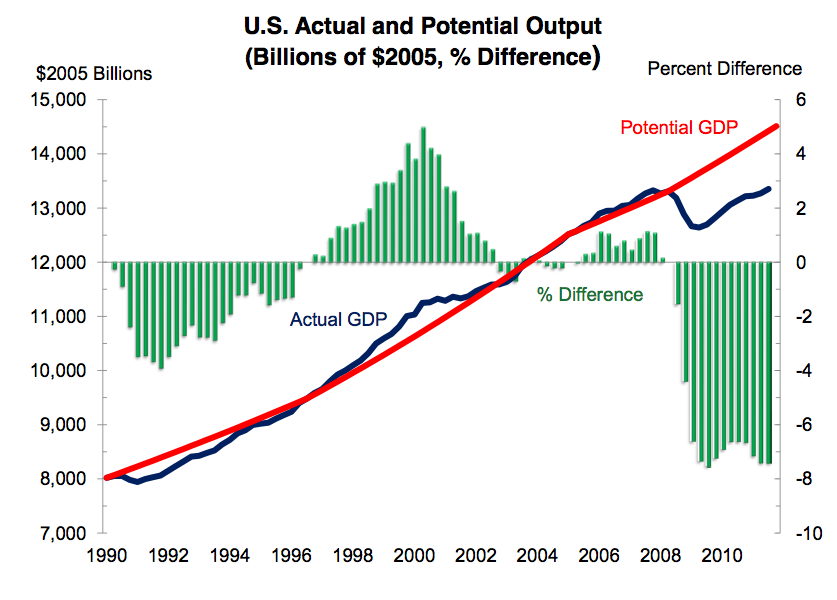

Now lets take a moment and relate back to crypto. If one of crypto’s objectives is to stop the usage of banks then we will inadvertently (in theory) hurt the economy. The result of this unidentified growth will hurt the economy. With less capital in the economy the potential output curve

which has grown every single year, could possibly be negatively impacted.

Why? Because the potential output curve (GDP in other words (well kinda, but that’s a higher level topic)) only grows as a result of a growth in Capital (which wont occur in a crypto-dominated world – since fractional reserve banking won’t exist) and productivity (and productivity grows because of investment, and labour – which all needs capital).

So in sum, the result might be well, a stagnated economy.

These are just my thoughts, feel free to berate me, or disagree !

Most (if not all) cryptocurrencies work by having a set capital limit on the circulation of the coin. Whether that be Bitcoin, Etherum, Ripple, or Doge coin, there is a set limit. In relation, this is how all standard since governing bodies like the federal reserve work, as they also put (mostly try) a limit on how much fiat money should circulate. That’s all fine and dandy, but I think an important point we’re missing is that even though the fed puts a limit on the amount of fiat produced, the amount of capital that the economy has grows naturally everyday !

This process is known as Fractional Reserve Banking, and it is the backbone of well, just about any economy that we have today. How fractional banking works is actually quite simple. Lets say Bob walks into his local bank with $1000 in his pocket to deposit into his account. The bank now has a $1000 liability in their book (of Bob’s cash). Lets also assume that monetary policy has stated that all banks must have a 10% reserve requirement. Accordingly, the bank must have at all times 10% of Bob’s money at their disposal ($100). The other $900 can be used to do as they wish, which they usually loan with, for the obvious reason so they can earn interest on that Loan.

They then loan the $900 to Lisa. Now lets stop for a moment and reflect. The economy at this point has grown by $900. But how you ask, well Bob has $1000 and Lisa now has $900 ! So our simplified economy is worth $1900 !

Lets take this one step further, Lisa then depoists her $900 in her bank, which also has a 10% reserve requirement. The bank as a result must hold at all times $90, and can lend out $810, which it does to Joe. Reflection: At this point the economy is now worth $1000 + $900 + $810 = $2710

In summary, the multiplier affect states that the economy will be worth $1000 * (1/0.1)

$10’000 as a result of fractional reserve banking. Crazy huh, Bob’s simple $1000 grew the economy by $9000.

Now lets take a moment and relate back to crypto. If one of crypto’s objectives is to stop the usage of banks then we will inadvertently (in theory) hurt the economy. The result of this unidentified growth will hurt the economy. With less capital in the economy the potential output curve

which has grown every single year, could possibly be negatively impacted.

Why? Because the potential output curve (GDP in other words (well kinda, but that’s a higher level topic)) only grows as a result of a growth in Capital (which wont occur in a crypto-dominated world – since fractional reserve banking won’t exist) and productivity (and productivity grows because of investment, and labour – which all needs capital).

So in sum, the result might be well, a stagnated economy.

These are just my thoughts, feel free to berate me, or disagree !

Last edited: